The old playbook for money—get a job, save for retirement, collect a pension—feels, well, ancient. It just doesn’t fit the reality for a growing number of us. If you’re a freelancer, a creative, a gig worker, or an entrepreneur, your income probably doesn’t look like a straight, predictable line. It’s more like a heartbeat monitor on an exciting day—peaks, valleys, and the occasional flatline that makes you sweat.

That volatility can be terrifying. But here’s the deal: it’s also manageable. With a financial plan built for the real world of irregular income, you can trade that constant anxiety for genuine confidence. Let’s build a financial safety net that’s as flexible and resilient as you are.

Rethinking the “Paycheck”: Mastering Your Cash Flow

The first, and most crucial, step is to ditch the monthly paycheck mentality. You need to think in terms of annual income, broken down into manageable chunks. This is the cornerstone of financial planning for freelancers.

The “Peaks and Valleys” Budgeting System

Forget trying to predict next month’s income down to the dollar. Instead, work with a baseline. Calculate your absolute bare-bones monthly expenses—rent, utilities, groceries, minimum debt payments. This is your “Valley” number, the floor you cannot fall below.

Then, during your “Peak” months (those glorious times with multiple client payments), you fund your valley. Honestly, it’s like being your own personal finance manager. You’re essentially paying your future self a steady salary.

Here’s a simple way to visualize it:

| Income Tier | What to Do With It |

| Essential Needs (Valley) | Covers rent, food, utilities, absolute necessities. |

| Financial Stability | Funds your emergency savings, taxes, retirement. |

| Growth & Lifestyle | Goes to investments, business upgrades, and, yes, fun. |

Taming the Tax Beast

This is non-negotiable. As a self-employed professional, no one is withholding taxes for you. A common rookie mistake is spending a large client payment, only to face a massive tax bill later.

Set up a separate, high-yield savings account—label it “TAXES”—and automatically transfer 25-30% of every single payment you receive into it. Think of it as your first and most important business expense. It’s not your money; it’s the government’s, and you’re just holding it for them.

Building Your Financial Shock Absorbers

In a traditional job, a slow month might mean less overtime. In your world, it could mean zero income. That’s why your safety nets need to be bigger, and honestly, more robust.

The Layered Emergency Fund

You’ve probably heard the standard “3-6 months of expenses” rule. For the nontraditional career path, I recommend thinking in layers. It’s like having a financial first-aid kit and then a full-blown emergency room in reserve.

First, aim for one month of your “Valley” expenses in an easily accessible checking or savings account. This is for immediate, unexpected costs.

Next, build a core emergency fund of 3-6 months of those baseline expenses in a high-yield savings account. This is your income-replacement fund for dry spells.

And if you can, a third tier—another 3 months—acts as a catastrophic buffer. It’s overkill until you desperately need it, and then it’s a lifesaver.

Retirement? Yes, You Still Need To Plan For It

No 401(k) match? No problem. You have powerful options, you know. In fact, you can often save more than your traditionally employed friends.

Explore these vehicles for retirement planning for self-employed individuals:

- SEP IRA: Simple to set up, allows you to contribute up to 25% of your net earnings.

- Solo 401(k): More complex but offers higher contribution limits, especially if you’re over 50.

- Roth IRA: Funded with after-tax money, so your withdrawals in retirement are tax-free. A fantastic supplement.

The key is to automate this. Set up a monthly transfer, even if it’s small, from your business account to your retirement account. Make it a bill you pay to your future self.

Beyond the Basics: Protecting Your Livelihood

Financial health isn’t just about saving; it’s about protecting what you’ve built. For those with an irregular income, a single accident or lawsuit can be devastating.

Insurance is Your Silent Business Partner

It feels like an annoying expense until it’s not. Health insurance is the big one—explore the Marketplace, professional associations, or even spouse’s plans. But don’t stop there.

Consider disability insurance. If you break your wrist and you’re a graphic designer, how do you work? Disability insurance provides a portion of your income if you can’t. And if you have clients visiting your home office or provide advice, look into professional liability insurance. It’s a safety net for your reputation and your bank account.

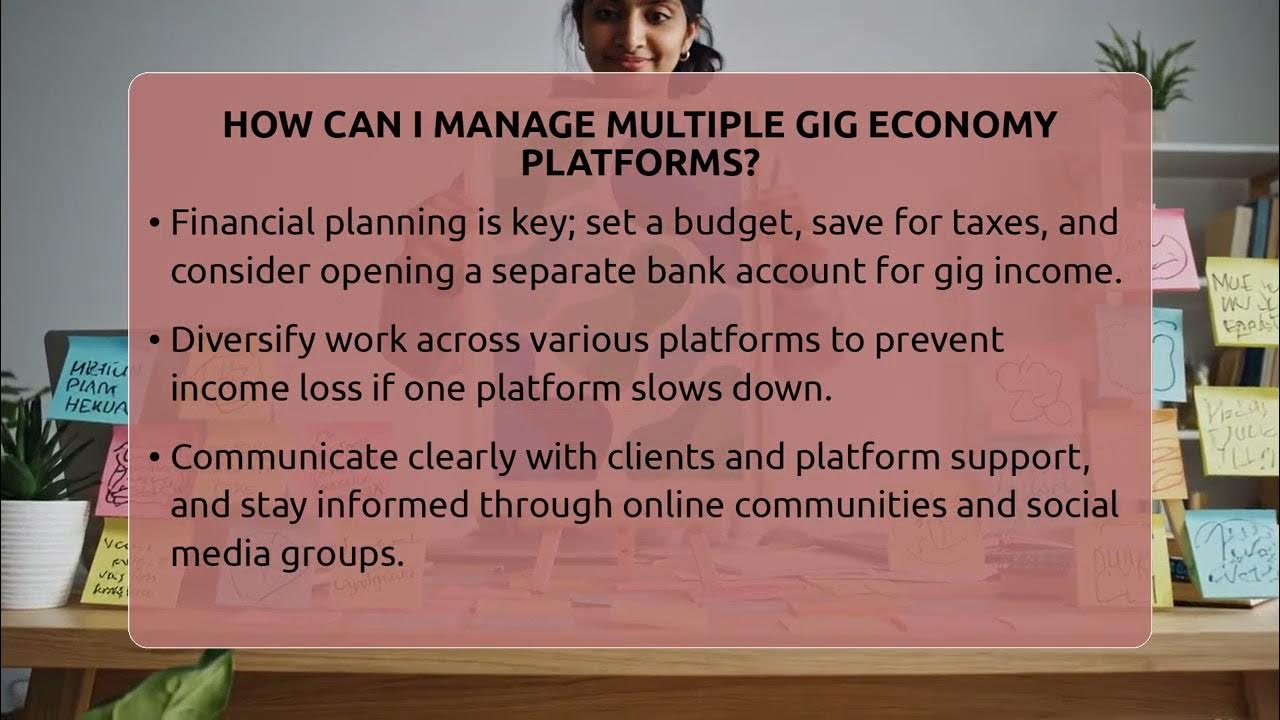

Diversify Your Income Streams

This is the ultimate modern financial strategy. Don’t put all your eggs in one client’s basket. Actively work on creating multiple streams of income. It could be a mix of:

- Active client work (your main gig)

- A digital product (an ebook, a course, presets)

- Passive income from a blog or affiliate marketing

- Short-term contract or “gig” platform work to fill valleys

This approach not only smooths out cash flow but also reduces the panic if one income source suddenly disappears. It’s the financial equivalent of having multiple anchors holding your boat steady.

Embracing the Mindset

Ultimately, managing money on a nontraditional career path is as much about psychology as it is about math. It requires a shift from seeing volatility as a threat to viewing it as a system to be managed. You’re not just a creative or a freelancer; you’re the CEO of You, Inc.

That means paying yourself first, investing in your company’s (your) future, and ensuring the business is resilient. It’s not about restricting your life; it’s about funding the freedom you originally sought. The goal isn’t to replicate the rigidity of a traditional job, but to build a foundation so solid that the unpredictable nature of your work becomes its greatest thrill, not its greatest fear.